The common strategy in the transportation and handling of goods is the lowering of costs and improving the quality of service for the end-user.

Logistics Trading Services (LTS) is a cloud based standard solution facilitating process automation pertaining to the import-, warehousing and export of goods.

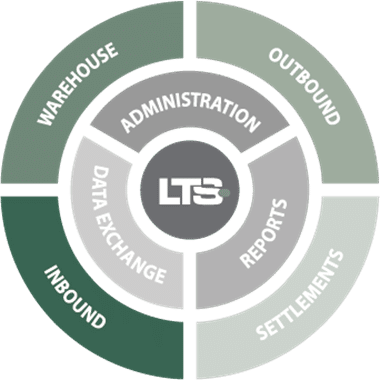

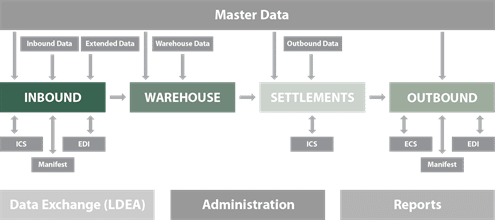

LTS is based on four main modules, Inbound, Warehouse, Settlements and Outbound and heavily supported by common modules, Data Exchange, Reports and Administration. Each module provides a variety of applications to support every process in the documentation of goods imported from non-EU territories, ensuring that duty is paid on goods destined for EU consumption.

LTS comes with all necessary customs related data pre-installed and provides data adaptors for integration to external systems and trading partners. Each adaptor or interface provides its own Data Refinement Module ensuring high standards, minimal errors and the possibility for fully automated customs declarations activated from a parent ERP-system. File transactions are handled by an internal file manager (LDEA) running 24/7, handling internal and external communication.

If you use bonded warehousing, LTS helps you to manage the necessary processes surrounding this, ensuring that customs duty is either:

Comprehensive documentation is required of companies operating bonded warehouses. LTS takes care of this.

LTS provides you with the appropriate knowledge and overview, putting you in control to achieve the most economical and smoothest customs processing.

Do you want to hear more about LTS, please contact Claus Bruus Olesen on cbo@lector.dk or call directly on mobile +45 31 41 49 10 for an informal presentation.

Get help with TeamShare, ESS or LTS.

We do everything to ensure that you can get exactly the help you need.

If you need help or guidance regarding which solution is best for your company or association, give us a call or write us an email.

+45 44 50 21 50

info@lector.dk

Lector offers a wide range of IT services.

From complete solutions for handling customs warehouses, document management and case management, to increased knowledge sharing and streamlining of work processes.

© 2024 Lector – Designed by Aveo web&marketing – Privacy policy – Cookie policy